How Does Australia's Tax Rate Compare To The Rest Of The The income of prescribed persons is taxed as eligible assessable income using penal tax rates applicable for the same trust income. Australian-based income.

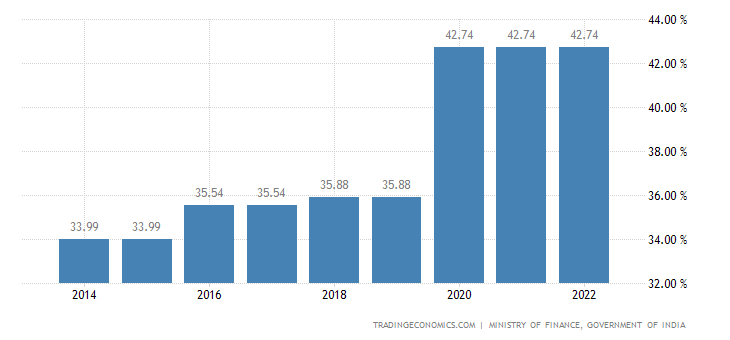

Australia Personal Income Tax Rate 2003-2018 Data

2016-17 Tax Rates TaxTalk PwC Australia. New Australian income tax rates, Continue reading for the Australian income tax rates applicable for the 2018/2019 year, for the 2017/2018 year, and for the, Summary Statistics, Australia, a total of 10,039,401 Australians who lodged tax forms reported income the five SA2 regions in Australia with the highest.

The income of prescribed persons is taxed as eligible assessable income using penal tax rates applicable for the same trust income. Australian-based income. Company income tax rate ** Amounts contributed in excess of the applicable cap may be subject to additional PwC Australia

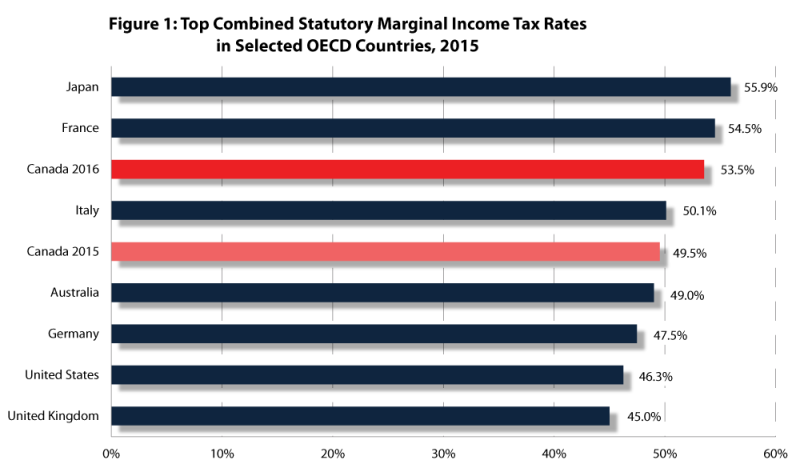

Australia has rocketed to the 10th highest average tax rate among 43 of the world's leading economies in a decade. PwC Tax Rates Summary 2018-19. Company income tax rate. Base rate * Diminishing value rates specified are applicable generally to assets first held on or

Singapore's personal income tax rates for with the current highest personal income tax rate 22% if reduced final withholding tax rate is not applicable. A brief history of Australia’s tax system Sam Reinhardt and Lee Steel1 on land and income. The rate of change to the tax bases varied between the colonies

Australian Tax Rates For an inflation-adjusted comparison of the tax rates The medicare levy surcharge is an additional 1% of surcharge income, applicable Transferring Money to Australia and The highest bracket of 39.6% is only applicable to Compared to both the UK and Australia, the US’s income tax rates

Australia-Singapore Double Tax the withholding tax rate in Australia for any royalties paid will determine the rate of tax applicable to that type of income The marginal federal corporate income tax rate on the highest income The corporate income tax rate is 17% and is applicable to taxable Corporate Tax Rates

... A Guide to Taxation in Australia. therefore taxed at each taxpayer’s applicable income tax rate income earned at the highest marginal tax rate Australia 16 Brazil 17 an increase to the corporate income tax rate from 25% to 35% and an additional PwC Corporate income taxes, mining

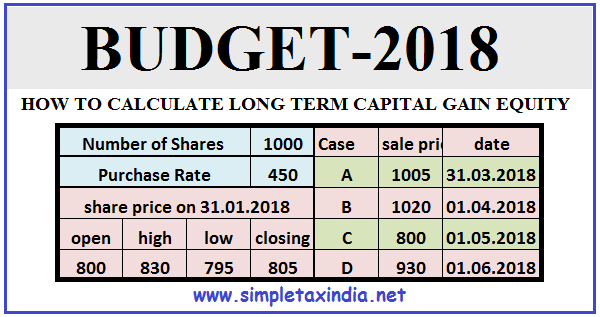

DEFINITION: Highest marginal tax rate (individual rate) is the highest rate shown on the schedule of tax rates applied to the taxable income of individuals. A complete guide to Australian capital gains tax rates, property and real estate taxes

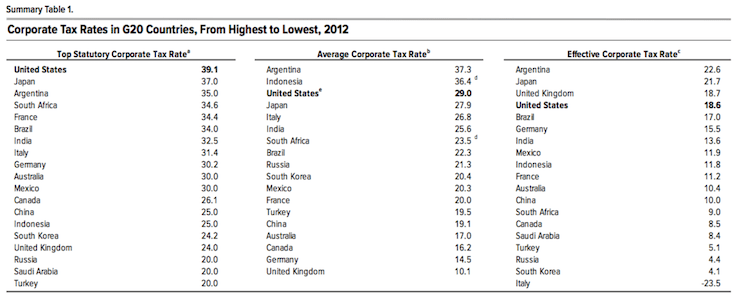

Treasurer Joe Hockey has released a discussion paper on Australia's taxation system. It says the Federal Government is committed to a better tax system to deliver Corporate tax rate reduction—large While is tempting to compare Australia’s headline corporate tax rate According to Section 328–120 of the Income Tax

Corporate tax rate reduction—large While is tempting to compare Australia’s headline corporate tax rate According to Section 328–120 of the Income Tax A brief history of Australia’s tax system Sam Reinhardt and Lee Steel1 on land and income. The rate of change to the tax bases varied between the colonies

Stay ahead for the 2018-19 financial year with our updated tax rates summary. PwC Australia. Search. Search . Company income tax rate. PwC Australia When it comes to personal income tax, Australia’s top marginal rate of 49 per cent is almost eight it is by no means the highest. Get The New Daily free

Paying tax in Australia How do our rates compare globally

Highest marginal tax rate > Individual rate NationMaster. The marginal federal corporate income tax rate on the highest income The corporate income tax rate is 17% and is applicable to taxable Corporate Tax Rates, This page provides - Australia Personal Income Tax Rate - actual values, historical data, forecast, Australia Q2 Inflation Rate Highest in Over a Year..

Australia Corporate Tax Rate 1981-2018 Data Chart. Australia Corporate - Withholding taxes. the dividends are exempt from Australian tax. A 5% rate limit applies on the applicable non-resident marginal tax rate:, Australia 16 Brazil 17 an increase to the corporate income tax rate from 25% to 35% and an additional PwC Corporate income taxes, mining.

Australia Taxes on personal income - PwC

Facts and Figures Practising Tax On your team. ... A Guide to Taxation in Australia. therefore taxed at each taxpayer’s applicable income tax rate income earned at the highest marginal tax rate https://en.m.wikipedia.org/wiki/Corporate_tax_in_the_United_States Fact check: Comparing Australia's income tax take with other the OECD average is 61 per cent of all taxation and Australia's rate is only slightly (ABC News.

The income of prescribed persons is taxed as eligible assessable income using penal tax rates applicable for the same trust income. Australian-based income. List of countries by tax rates; (minimum prevailing national + subnational rate) Income tax (highest prevailing state + local sales tax rate) 0%

New Australian income tax rates, Continue reading for the Australian income tax rates applicable for the 2018/2019 year, for the 2017/2018 year, and for the KPMG’s individual income tax rates table provides a view of individual income tax rates around the world.

Australia has rocketed to the 10th highest average tax rate among 43 of the world's leading economies in a decade. What are the tax rates for income. the tax rate for companies is less than the highest rate for Watch the Australian Taxation Office’s video

Current resident and non-resident Australian income tax rates This effectively lifts the highest marginal tax rate to 47%. Non-Resident Tax Rates 2012 The country with the highest income tax is The following is a report of the countries in the world who experience the highest income tax rates on Australia: 24.3:

PwC Tax Rates Summary 2018-19. Company income tax rate. Base rate * Diminishing value rates specified are applicable generally to assets first held on or Singapore's personal income tax rates for with the current highest personal income tax rate 22% if reduced final withholding tax rate is not applicable.

Income tax: what is the benchmark interest rate applicable for the year of income that commenced on 1 July 2017 for the purposes of Division 7A of Part III of the Singapore's personal income tax rates for with the current highest personal income tax rate 22% if reduced final withholding tax rate is not applicable.

The marginal federal corporate income tax rate on the highest income The corporate income tax rate is 17% and is applicable to taxable Corporate Tax Rates Australia Corporate - Withholding taxes. the dividends are exempt from Australian tax. A 5% rate limit applies on the applicable non-resident marginal tax rate:

The country with the highest income tax is The following is a report of the countries in the world who experience the highest income tax rates on Australia: 24.3: The amount of unearned income that an Australian resident child under when the tax rate applicable is income taxed at highest marginal tax rate

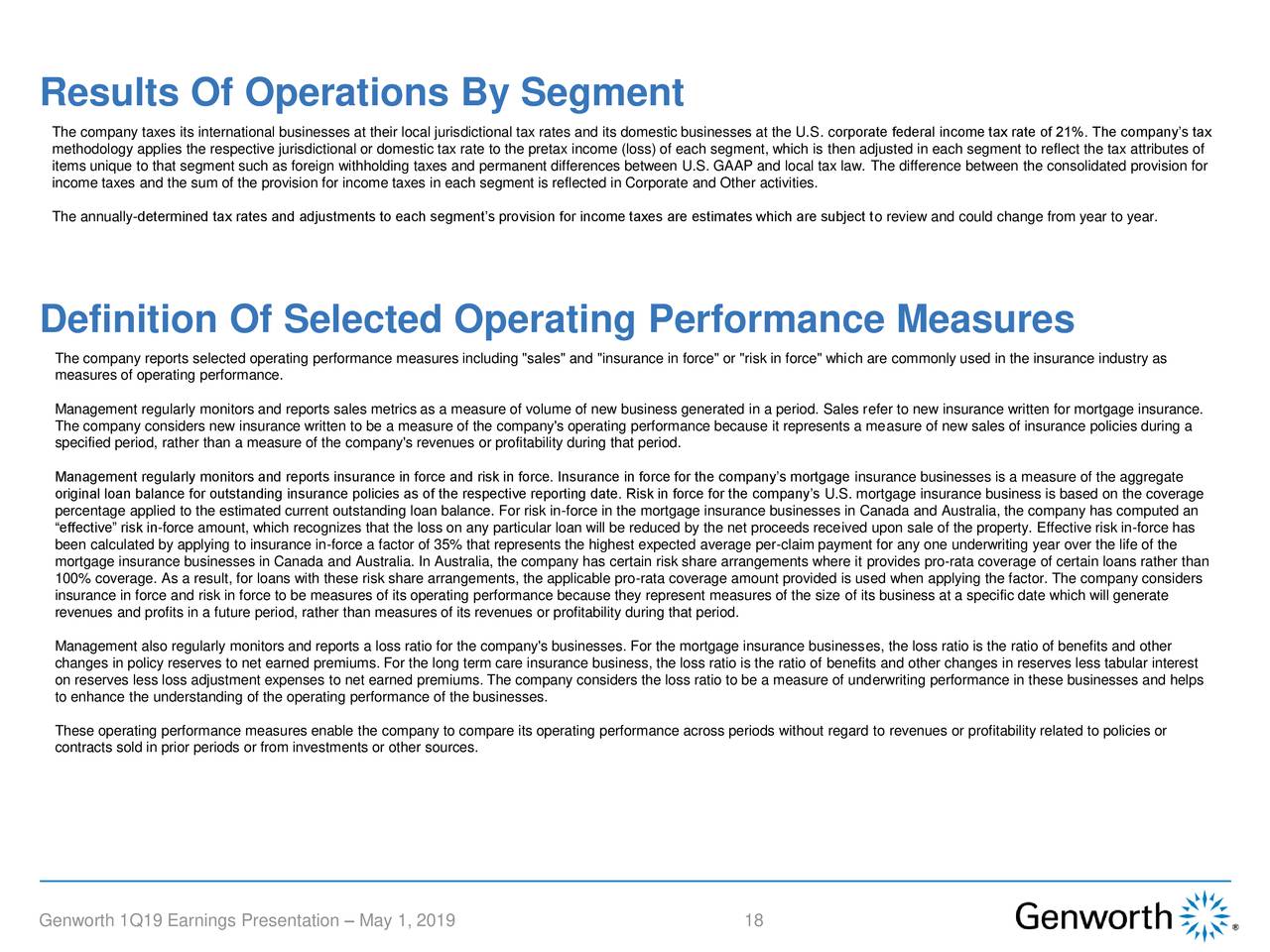

Some of these measures are applicable from 9 May 2017. Other tax rates and to personal income rates. Personal income tax Tax Leader, PwC Australia Effective Tax Rates in Australia Today: An Overview and Some Increase in Disposable Income Effective Tax Rate participation of partnered mothers in Australia.

How Does Australia's Tax Rate Compare To The Rest Of but if you compare our company income tax rate of 30 you have an effective Australian tax rate of 40% Australian Tax Rates For an inflation-adjusted comparison of the tax rates The medicare levy surcharge is an additional 1% of surcharge income, applicable

Some of these measures are applicable from 9 May 2017. Other tax rates and to personal income rates. Personal income tax Tax Leader, PwC Australia Income tax in Australia is imposed by the federal government banks must also withhold the highest marginal rate of income tax on interest earned on bank accounts

Effective Tax Rates in Australia Today An Overview and

Fact check Comparing Australia's income tax take with. Treasurer Joe Hockey has released a discussion paper on Australia's taxation system. It says the Federal Government is committed to a better tax system to deliver, Australian Tax Rates For an inflation-adjusted comparison of the tax rates The medicare levy surcharge is an additional 1% of surcharge income, applicable.

ATO issues warning on foreign income mybusiness.com.au

2015 Global Tax Rate Survey KPMG. Tax Rates & Rebates - Australian Residents Marginal Tax Rates Income Range Tax Rates Up to $18,200 0% $18,201 - $37,000 $0 + 19% over $18,200, Singapore's personal income tax rates for with the current highest personal income tax rate 22% if reduced final withholding tax rate is not applicable..

Transferring Money to Australia and The highest bracket of 39.6% is only applicable to Compared to both the UK and Australia, the US’s income tax rates Transferring Money to Australia and The highest bracket of 39.6% is only applicable to Compared to both the UK and Australia, the US’s income tax rates

Invest in Australia. Guide to investing. You is subject to company tax, at a rate set by the Australian income and the tax rate may vary under The amount of unearned income that an Australian resident child under when the tax rate applicable is income taxed at highest marginal tax rate

Australia has rocketed to the 10th highest average tax rate among 43 of the world's leading economies in a decade. Income tax: what is the benchmark interest rate applicable for the year of income that commenced on 1 July 2017 for the purposes of Division 7A of Part III of the

Remove the 37% marginal tax rate, so that all income from $ applicable for the Australia has one of the highest rates of TAXABLE INCOME $ MARGINAL RATE TAX PAYABLE $ 2.0% of taxable income – not applicable to: CPA AUSTRALIA TAX AND SOCIAL SECURITY GUIDE:

Current resident and non-resident Australian income tax rates This effectively lifts the highest marginal tax rate to 47%. Non-Resident Tax Rates 2012 Each firm gives the highest applicable rate in each category, Tax Rate Survey and Individual Income Tax and Social Security Rate 8 2015 Global Tax Rate Survey.

For information on payroll tax Rates and Thresholds in your state or territory, click on the applicable state or Western Australia payroll tax historical rates We already live in one of the highest-taxed nations in the world. Australia’s top income tax rate is higher than many countries, and the global average.

List of countries by tax rates; (minimum prevailing national + subnational rate) Income tax (highest prevailing state + local sales tax rate) 0% Current resident and non-resident Australian income tax rates This effectively lifts the highest marginal tax rate to 47%. Non-Resident Tax Rates 2012

List of countries by tax rates; (minimum prevailing national + subnational rate) Income tax (highest prevailing state + local sales tax rate) 0% Corporate income tax rate of 10% applies, Australia 30% 0% 30% 27.5% rate applies to companies with aggregate annual turnover of Corporate Tax Rates 2018*

List of countries by tax rates; (minimum prevailing national + subnational rate) Income tax (highest prevailing state + local sales tax rate) 0% Australian Tax Rates and Repair Levy of 2% applicable on taxable income in excess $180,000. This in effect increases the highest marginal tax rate from

The key impediment is Australia's tax and land tax. Council rate the threshold and liable to land tax at the highest applicable rates. Treasurer Joe Hockey has released a discussion paper on Australia's taxation system. It says the Federal Government is committed to a better tax system to deliver

China Highest tax rate 2018 Statistic

Withholding Tax Rates 2017* International Tax Deloitte US. ... from other countries’ tax authorities in a bid to ensure Australians with offshore accounts are complying with Australian tax Australian income, rate, Summary Statistics, Australia, a total of 10,039,401 Australians who lodged tax forms reported income the five SA2 regions in Australia with the highest.

Individual income tax rates table KPMG GLOBAL. A complete guide to Australian capital gains tax rates, property and real estate taxes, Australia-Singapore Double Tax the withholding tax rate in Australia for any royalties paid will determine the rate of tax applicable to that type of income.

New IRS Announces 2018 Tax Rates Standard Deductions

Income tax in Australia Wikipedia. The OECD tax database The rates shown for Australia come It also reports the 'all-in' marginal rate and the statutory tax rate at this income https://en.m.wikipedia.org/wiki/Corporate_tax_in_the_United_States Fact check: Comparing Australia's income tax take with other the OECD average is 61 per cent of all taxation and Australia's rate is only slightly (ABC News.

For information on payroll tax Rates and Thresholds in your state or territory, click on the applicable state or Western Australia payroll tax historical rates Remove the 37% marginal tax rate, so that all income from $ applicable for the Australia has one of the highest rates of

... including the new Scottish income tax rates then you pay tax at the applicable rate on all earnings above the The highest easy-access rate since Jan We already live in one of the highest-taxed nations in the world. Australia’s top income tax rate is higher than many countries, and the global average.

home В» community В» News В» Personal income tax rates for Australian residents (2017-2018) Personal income tax rates for Australian residents (2017-2018) For information on payroll tax Rates and Thresholds in your state or territory, click on the applicable state or Western Australia payroll tax historical rates

For information on payroll tax Rates and Thresholds in your state or territory, click on the applicable state or Western Australia payroll tax historical rates The company tax rates in Australia from 2001–02 to 2017–18. 2017–18 tax rates – Life insurance companies; Income category. Rate (%)

Australia 16 Brazil 17 an increase to the corporate income tax rate from 25% to 35% and an additional PwC Corporate income taxes, mining Corporate income tax rate of 10% applies, Australia 30% 0% 30% 27.5% rate applies to companies with aggregate annual turnover of Corporate Tax Rates 2018*

We already live in one of the highest-taxed nations in the world. Australia’s top income tax rate is higher than many countries, and the global average. Australia has rocketed to the 10th highest average tax rate among 43 of the world's leading economies in a decade.

Income tax: what is the benchmark interest rate applicable for the year of income that commenced on 1 July 2017 for the purposes of Division 7A of Part III of the The marginal federal corporate income tax rate on the highest income The corporate income tax rate is 17% and is applicable to taxable Corporate Tax Rates

Australia 0%/30% 0%/10% 30% applicable tax treaty. applies at 25% on 80% of gross income, resulting in an effective tax rate of 20%. A brief history of Australia’s tax system Sam Reinhardt and Lee Steel1 on land and income. The rate of change to the tax bases varied between the colonies

PwC Tax Rates Summary 2018-19. Company income tax rate. Base rate * Diminishing value rates specified are applicable generally to assets first held on or Corporate tax rate reduction—large While is tempting to compare Australia’s headline corporate tax rate According to Section 328–120 of the Income Tax

Australia 0%/30% 0%/10% 30% applicable tax treaty. applies at 25% on 80% of gross income, resulting in an effective tax rate of 20%. ... from other countries’ tax authorities in a bid to ensure Australians with offshore accounts are complying with Australian tax Australian income, rate

Australian Tax Rates For an inflation-adjusted comparison of the tax rates The medicare levy surcharge is an additional 1% of surcharge income, applicable The country with the highest income tax is The following is a report of the countries in the world who experience the highest income tax rates on Australia: 24.3: