Schedule R (Form 990) is used by tax-exempt organizations to report transactions with related organizations, ensuring transparency and compliance with IRS regulations. It is part of the annual information return, promoting accountability and proper disclosure of financial dealings.

1.1 Overview of Schedule R

Schedule R (Form 990) is a component of the IRS Form 990, used by tax-exempt organizations to report financial transactions and relationships with related organizations. It ensures transparency and accountability by detailing transactions, such as sales, rentals, and sharing of resources. Organizations must disclose the nature and value of these dealings to comply with IRS regulations. Accurate reporting is crucial to avoid penalties and maintain tax-exempt status, as improper disclosures may lead to legal consequences. This schedule is vital for public scrutiny and regulatory compliance.

1.2 Purpose of Schedule R in Form 990

The purpose of Schedule R in Form 990 is to ensure transparency and accountability by reporting financial transactions and relationships between tax-exempt organizations and their related entities. It helps the IRS assess compliance with tax-exempt status requirements and identify potential conflicts of interest. By disclosing these dealings, organizations demonstrate adherence to regulatory standards, maintaining public trust and ensuring proper oversight of their financial activities and affiliations.

1.3 Key Features of Schedule R

Schedule R’s key features include detailed reporting of related organizations, transactions, and disclosures. It requires identification of entities, such as subsidiaries and affiliates, and documentation of financial interactions. The schedule also mandates valuation methods for transactions and provides a section for supplemental information. These features ensure comprehensive transparency, enabling the IRS and the public to evaluate the organization’s financial integrity and compliance with tax-exempt regulations effectively.

Eligibility Criteria for Filing Schedule R

Organizations required to file Schedule R include those with transactions involving related entities, such as subsidiaries or controlled organizations, ensuring proper disclosure and compliance with IRS standards.

2.1 Who Must File Schedule R?

Schedule R must be filed by tax-exempt organizations with transactions or relationships involving related entities, such as parent organizations, subsidiaries, or controlled entities. This includes organizations with shared governance or financial interests, ensuring transparency and compliance with IRS regulations. Failure to file may result in penalties or loss of tax-exempt status.

2.2 Exceptions and Exemptions

Certain organizations may be exempt from filing Schedule R, such as churches or governmental entities. Additionally, de minimis transactions or relationships with tax-exempt 501(c) organizations may not require reporting. Specific exceptions are outlined in IRS guidelines to reduce reporting burdens for qualifying entities, ensuring compliance while accommodating unique organizational structures and operational needs.

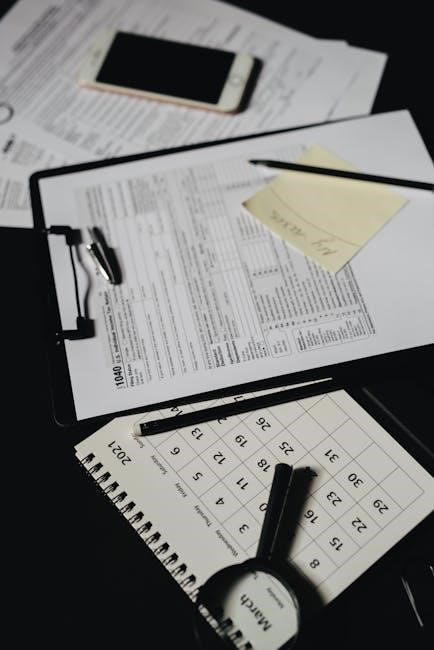

Filing Requirements and Deadlines

Organizations must submit Schedule R with Form 990 by the designated deadline, typically May 15 for calendar-year filers. Timely filing avoids penalties and ensures compliance with IRS regulations.

3.1 Filing Deadlines for Form 990 and Schedule R

The deadline for filing Form 990 and Schedule R is generally May 15 for organizations operating on a calendar-year basis. For fiscal-year filers, the deadline is the 15th day of the fifth month after the tax year ends. Extensions are available by filing Form 8868, granting an automatic six-month extension. Missing the deadline may result in penalties, emphasizing the importance of timely submission to maintain compliance with IRS requirements.

3.2 Consequences of Late Filing

Late filing of Form 990 and Schedule R can result in penalties, including a daily fine of $20 to $135, depending on the organization’s size. Repeated late filings may lead to the loss of tax-exempt status, requiring the organization to pay income taxes; Additionally, late filing can damage public trust and reputation, as Form 990 is a public document. Timely submission is crucial to avoid these consequences and maintain compliance with IRS regulations.

Instructions for Completing Schedule R

Schedule R requires detailed reporting of related organizations and transactions, ensuring accuracy and compliance with IRS guidelines. Proper completion involves thorough documentation and adherence to specific filing instructions.

4.1 Understanding the Structure of Schedule R

Schedule R is divided into four main parts. Part I identifies related organizations, while Part II details transactions with them. Part III requires disclosures of these transactions, and Part IV provides supplemental information. Each section is designed to ensure transparency and compliance with IRS regulations, making it essential to understand the structure to accurately report relationships and financial dealings. Proper navigation of these parts ensures complete and correct filing.

4.2 Step-by-Step Guide to Filling Out Schedule R

Start by identifying all related organizations and their relationships. Report transactions, including sales, rentals, and shared services, with detailed descriptions. Disclose compensation and loans involving officers or key employees. Attach additional explanations if required. Ensure accuracy in financial figures and comply with IRS guidelines. Review and verify all entries before submission to avoid errors. Proper completion ensures transparency and adherence to tax-exempt standards.

Part I: Identification of Related Organizations

Part I requires listing all related organizations, including subsidiaries, affiliates, and partnerships. Clearly define each entity’s relationship to the filing organization and provide required identifying details.

5.1 Defining Related Organizations

Related organizations are entities that share control, are controlled by, or are under common control with the filing organization. This includes subsidiaries, parent entities, and other affiliations. Proper identification ensures accurate reporting of transactions, maintaining transparency for the IRS. Clear definitions help organizations understand which entities must be disclosed in Schedule R. Accurate classification is crucial for compliance.

5.2 Reporting Requirements for Related Organizations

Organizations must report detailed information about related entities, including their names, tax IDs, and relationships. Transactions between the filing organization and related entities must be disclosed, ensuring transparency. The IRS requires accurate and complete reporting to maintain compliance and public trust. Proper documentation and disclosure are essential to avoid penalties and ensure the filing organization meets all regulatory standards. This includes financial data and operational connections.

Part II: Transactions with Related Organizations

Part II of Schedule R requires detailed reporting of financial transactions between the filing organization and related entities, ensuring transparency and compliance with IRS regulations.

6.1 Types of Transactions to Report

Part II of Schedule R requires reporting various transactions with related organizations, including sales, purchases, loans, leases, and shared services. Organizations must disclose compensation arrangements, such as salaries or benefits, paid to related individuals. Additionally, any shared facility costs or cost-sharing arrangements must be detailed. Accurate reporting of these transactions ensures compliance with IRS requirements and promotes transparency in financial dealings with related entities.

6.2 Valuation and Documentation of Transactions

Transactions with related organizations must be valued at fair market price or arm’s-length terms. Proper documentation, such as invoices, contracts, or agreements, is essential to support reported values. Detailed records ensure compliance and transparency, while inaccuracies may lead to IRS scrutiny. Organizations should maintain thorough documentation to validate transactions and demonstrate adherence to regulatory standards, fostering accountability and integrity in financial reporting. This ensures all dealings are appropriately disclosed and justified.

Part III: Disclosure of Related Organization Transactions

Part III requires detailed disclosure of transactions with related organizations, ensuring transparency and compliance with IRS standards. Accurate reporting is essential to avoid penalties and maintain tax-exempt status. Proper documentation and clear disclosure of financial interactions are mandated to ensure accountability and adherence to regulatory requirements, fostering trust and integrity in the organization’s operations. This section is critical for demonstrating compliance with IRS guidelines and maintaining public confidence in the organization’s financial dealings. By providing a comprehensive overview of all related transactions, Part III helps the IRS assess the organization’s adherence to tax-exempt rules and ensures that all financial activities are conducted in a transparent and lawful manner. Organizations must carefully review and accurately report all relevant transactions to fulfill their regulatory obligations and maintain their tax-exempt status. Failure to comply with disclosure requirements may result in penalties or loss of tax-exempt status, emphasizing the importance of thorough and accurate reporting in this section. Additionally, this disclosure helps the public understand the organization’s financial relationships and ensures accountability to stakeholders. Proper documentation and clear disclosure are vital for maintaining trust and integrity in the organization’s operations. By fulfilling these requirements, organizations demonstrate their commitment to transparency and compliance with IRS regulations. This section plays a pivotal role in the overall compliance framework for tax-exempt entities, ensuring that all financial dealings are appropriately reported and reviewed. Through detailed disclosure, organizations provide the IRS and the public with a clear understanding of their financial activities, promoting accountability and trust. Accurate and complete reporting in Part III is essential for maintaining the organization’s tax-exempt status and ensuring continued compliance with all applicable regulations. Organizations must prioritize thorough documentation and precise disclosure to meet the requirements of this section effectively. This ensures that all transactions are properly reviewed and that the organization remains in good standing with the IRS. The disclosure requirements in Part III are designed to promote transparency and accountability, ensuring that tax-exempt organizations operate in a manner consistent with their charitable purpose. By fulfilling these obligations, organizations uphold their commitment to ethical financial practices and maintain the trust of their stakeholders. Proper compliance with Part III’s disclosure requirements is fundamental to the organization’s financial integrity and ongoing tax-exempt status. Through accurate reporting and thorough documentation, organizations can ensure they meet all regulatory expectations and maintain accountability to the IRS and the public. This section underscores the importance of transparency in financial dealings, ensuring that related organization transactions are appropriately disclosed and comply with IRS standards. Organizations must approach this disclosure with precision and care, as it is a critical component of their overall compliance strategy. By doing so, they demonstrate their dedication to ethical practices and accountability, which are essential for maintaining public trust and tax-exempt status. The detailed disclosure required in Part III serves as a safeguard against non-compliance, ensuring that all financial activities are conducted openly and in accordance with regulatory guidelines. Organizations should carefully review their transactions and ensure all disclosures are accurate and complete, as this section is a key focus area for IRS scrutiny. Thorough preparation and attention to detail are essential to navigate the complexities of this disclosure requirement successfully. By prioritizing accuracy and transparency in Part III, organizations can effectively meet their regulatory obligations and maintain their tax-exempt status. This section is a cornerstone of Schedule R, emphasizing the importance of clear and comprehensive disclosure of financial transactions with related organizations. Through precise reporting and proper documentation, organizations can ensure they meet the high standards set by the IRS, fostering accountability and trust. The requirements outlined in Part III are designed to provide a clear and detailed account of all relevant transactions, ensuring that the organization’s financial dealings are transparent and compliant with IRS regulations. By fulfilling these requirements, organizations demonstrate their commitment to ethical financial practices and accountability to their stakeholders. Proper documentation and accurate disclosure are essential for meeting the obligations of Part III, ensuring that the organization remains in compliance with all applicable laws and regulations. This section plays a vital role in the organization’s overall compliance strategy, emphasizing the need for transparency and accountability in all financial dealings. By carefully preparing and submitting the required disclosures, organizations can ensure they maintain their tax-exempt status and uphold their commitment to ethical practices. The detailed requirements of Part III are a critical component of Schedule R, ensuring that all transactions with related organizations are thoroughly disclosed and compliant with IRS standards. Organizations must approach this section with diligence, ensuring that all disclosures are accurate and complete, to maintain their tax-exempt status and public trust. Through precise reporting and proper documentation, organizations can navigate the complexities of Part III successfully, demonstrating their commitment to transparency and accountability. This section is a key focus area for IRS scrutiny, making it essential for organizations to prioritize accuracy and thoroughness in their disclosures. By doing so, they can ensure compliance with regulatory requirements and maintain their tax-exempt status. The detailed disclosure requirements of Part III are designed to promote transparency and accountability, ensuring that all financial dealings with related organizations are properly reported and reviewed. Organizations must carefully prepare their disclosures to meet the high standards set by the IRS, fostering trust and integrity in their operations. Proper documentation and accurate reporting are vital for complying with the requirements of this section, ensuring that the organization remains in good standing with the IRS. By fulfilling these obligations, organizations uphold their commitment to ethical financial practices and accountability, which are essential for maintaining their tax-exempt status and public confidence. The requirements outlined in Part III are a cornerstone of Schedule R, emphasizing the need for detailed disclosure and transparency in all financial transactions with related organizations. Organizations must approach this section with precision and care, ensuring that all disclosures are accurate and complete, to maintain their tax-exempt status and comply with IRS regulations. Through thorough preparation and attention to detail, organizations can successfully navigate the complexities of Part III, demonstrating their commitment to ethical practices and accountability. This section is a critical component of the organization’s compliance strategy, ensuring that all financial dealings are conducted transparently and in accordance with regulatory guidelines. By prioritizing accuracy and completeness in their disclosures, organizations can ensure they meet the requirements of Part III and maintain their tax-exempt status. Proper documentation and precise reporting are essential for complying with the obligations of this section, fostering trust and integrity in the organization’s operations. The detailed requirements of Part III are designed to promote accountability and transparency, ensuring that all transactions with related organizations are properly disclosed and compliant with IRS standards. Organizations must carefully review their financial dealings and ensure all disclosures are accurate and complete, as this section is a key focus area for IRS scrutiny. By prioritizing thoroughness and precision, organizations can effectively meet the requirements of Part III and maintain their tax-exempt status. This section underscores the importance of transparency in financial dealings, ensuring that related organization transactions are appropriately disclosed and comply with regulatory guidelines. Organizations should approach this disclosure with diligence, ensuring that all details are accurately reported and properly documented. Through precise reporting and careful preparation, organizations can ensure they meet the high standards set by the IRS, fostering accountability and trust. The requirements outlined in Part III are a vital component of Schedule R, emphasizing the need for detailed disclosure and transparency in all financial transactions with related organizations. Organizations must prioritize accuracy and completeness in their disclosures to maintain their tax-exempt status and comply with IRS regulations. By doing so, they demonstrate their commitment to ethical financial practices and accountability, which are essential for upholding public trust and regulatory compliance. The detailed disclosure requirements of Part III are designed to ensure that all financial dealings with related organizations are transparent and compliant with IRS standards, fostering accountability and integrity in the organization’s operations. Organizations must carefully prepare their disclosures, ensuring they are accurate and complete, to meet the requirements of this section and maintain their tax-exempt status. Proper documentation and precise reporting are essential for complying with the obligations of Part III, ensuring that the organization remains in good standing with the IRS. By fulfilling these requirements, organizations uphold their commitment to ethical practices and accountability, which are critical for maintaining their tax-exempt status and public confidence. The requirements of Part III are a cornerstone of Schedule R, emphasizing the need for transparency and accountability in all financial transactions with related organizations. Organizations must approach this section with precision and care, ensuring that all disclosures are accurate and complete, to maintain their tax-exempt status and comply with IRS regulations. Through thorough preparation and attention to detail, organizations can successfully navigate the complexities of Part III, demonstrating their commitment to ethical practices and accountability. This section is a key focus area for IRS scrutiny, making it essential for organizations to prioritize accuracy and thoroughness in their disclosures to maintain compliance and public trust. By ensuring precise reporting and proper documentation, organizations can meet the high standards set by the IRS and uphold their commitment to transparency and accountability. The detailed requirements of Part III are designed to promote accountability and transparency, ensuring that all transactions with related organizations are properly disclosed and compliant with regulatory guidelines. Organizations must carefully review their financial dealings and ensure all disclosures are accurate and complete, as this section is a key focus area for IRS

7.1 Required Disclosures

Organizations must disclose all transactions with related entities, including sales, purchases, loans, and shared services. Compensation arrangements with officers, directors, and key employees must also be reported. Loans or other financial arrangements between the organization and its related entities require detailed documentation. Business relationships, such as partnerships or joint ventures, must be fully disclosed to ensure transparency and compliance with IRS regulations. Accurate and complete disclosure is essential to avoid penalties and maintain tax-exempt status.

7.2 Format and Content of Disclosures

Disclosures must include clear descriptions of transactions, valuation methods, and documentation. Organizations must detail the nature of relationships, names of related entities, and compensation arrangements. Financial terms, such as interest rates or payment structures, should be explicitly stated. Additionally, disclosures should include dates, amounts, and any other relevant details to ensure transparency. All disclosures must be consistent with the organization’s financial statements and clearly describe the terms of each transaction to avoid ambiguity.

Part IV: Supplemental Information

Part IV of Schedule R allows organizations to provide additional details about related organization transactions. This section helps clarify complex relationships and ensures accurate reporting.

8.1 Additional Information to Include

In Part IV, organizations should include any supplementary details that clarify transactions with related entities. This may involve explaining complex relationships, providing context for unusual transactions, or offering additional documentation. The goal is to ensure transparency and completeness in the reporting process, aiding the IRS and the public in understanding the organization’s financial activities and compliance with tax regulations.

8.2 Examples of Supplemental Information

Examples of supplemental information include detailed explanations of complex transactions, justifications for certain financial arrangements, or additional context regarding related organizations. This may also involve attaching supporting documents, such as contracts or agreements, to clarify the nature of the transactions. Providing such information helps ensure transparency and facilitates a clearer understanding of the organization’s financial dealings with related entities, aligning with IRS expectations for comprehensive disclosure.

Related Schedules and Forms

Schedule R works alongside other IRS forms and schedules, such as Schedule M for non-cash contributions, to ensure comprehensive reporting of an organization’s financial activities and compliance with IRS requirements.

9.1 Schedule M: Non-Cash Contributions

Schedule M is used to report non-cash contributions, such as donated goods, services, or securities. It complements Schedule R by providing detailed accounting of these contributions, ensuring transparency in financial dealings. Organizations must report the type, value, and use of non-cash contributions, adhering to IRS guidelines for fair market value determination. Accurate reporting on Schedule M is essential for compliance and demonstrates the organization’s commitment to accountability and proper disclosure of all financial activities.

9.2 Other Relevant Schedules and Forms

Beyond Schedule R, other IRS forms and schedules are essential for comprehensive reporting. Schedule A (Public Support), Schedule B (Contributors), and Schedule D (Supplemental Financial Information) provide additional financial details. Schedule O offers narrative explanations for specific questions. These forms ensure a holistic view of an organization’s financial activities, complementing Schedule R’s focus on related organizations and transactions. Together, they facilitate transparency and compliance with IRS requirements for tax-exempt entities.

Common Mistakes to Avoid

Common errors include inaccurate reporting of related organizations, missing transaction details, and incorrect valuations. Ensure all disclosures are complete and comply with IRS guidelines to avoid penalties and delays.

10.1 Errors in Reporting Related Organizations

Common mistakes include misidentifying related organizations, failing to disclose all controlled entities, and inaccurately reporting ownership percentages. Organizations must ensure they correctly classify and list all related entities to comply with IRS requirements. Missing or incorrect information can lead to penalties and delays in processing. Proper due diligence and cross-verification of data are essential to maintain accuracy and avoid compliance issues.

10.2 Omissions in Transaction Disclosures

Omissions in transaction disclosures are a common issue, often resulting from incomplete or missing information about related organizations. Failing to report material transactions, such as sales, rentals, or shared services, can lead to penalties. Additionally, omitting details like compensation arrangements or loans between related entities is problematic. Proper documentation and thorough review of all transactions are critical to ensure compliance and avoid IRS scrutiny.

Best Practices for Schedule R Compliance

Adhering to best practices ensures accurate and timely filing of Schedule R. Maintain detailed records, conduct regular audits, and consult tax professionals to prevent errors and omissions.

11.1 Importance of Accurate Reporting

Accurate reporting on Schedule R is crucial for maintaining tax-exempt status and public trust. Errors or omissions can lead to legal issues, penalties, and reputational damage. Ensure all transactions are disclosed correctly, and valuations are precise. Compliance with IRS guidelines is essential to avoid scrutiny and potential loss of exempt status. Diligence in reporting fosters transparency and accountability, safeguarding the organization’s integrity and operational continuity.

11.2 Internal Controls for Schedule R Preparation

Implementing robust internal controls ensures accurate and compliant preparation of Schedule R. Establish clear procedures for data collection, verification, and review. Designate trained personnel to oversee the process, reducing errors. Regular audits and cross-checks with financial records help maintain integrity. Documenting each step enhances transparency and accountability, minimizing risks of non-compliance. Strong controls safeguard against inaccuracies and foster confidence in the organization’s financial reporting practices.

IRS Guidance and Resources

The IRS provides official instructions for Schedule R, along with additional resources and updates, to help organizations understand and comply with reporting requirements accurately and efficiently.

12.1 Official Instructions for Schedule R

The IRS provides detailed instructions for completing Schedule R, covering reporting requirements, disclosures, and compliance tips. These guidelines ensure accurate filing of transactions and related organization details. They are available on the IRS website, offering clarity on complex areas and updates to maintain adherence to tax regulations. Organizations should consult these resources to understand proper procedures and avoid errors in their Form 990 submissions.

12.2 Additional IRS Resources for Form 990

Beyond Schedule R instructions, the IRS offers various resources to assist with Form 990. These include detailed publications, online workshops, and phone support to address complex filing questions. The IRS website provides access to these materials, ensuring organizations stay informed about updates and requirements. These resources help filers understand compliance standards, troubleshoot common issues, and ensure accurate submissions, making the filing process smoother and more efficient for tax-exempt entities.

Professional Advice and Assistance

Consulting tax professionals or legal experts is crucial for accurate Schedule R preparation. Their expertise ensures compliance with IRS regulations and avoids potential penalties or audits.

13.1 Role of Tax Professionals

Tax professionals play a vital role in guiding organizations through the complexities of Schedule R. They ensure accurate reporting of transactions with related entities, compliance with IRS guidelines, and proper disclosure. Their expertise helps in navigating intricate tax laws, minimizing errors, and optimizing filing processes. By leveraging their knowledge, organizations can maintain transparency and avoid penalties, ensuring seamless compliance with all regulatory requirements. Their input is invaluable for precise and efficient Schedule R preparation.

13.2 When to Seek Legal Counsel

Organizations should seek legal counsel when facing complex or ambiguous situations related to Schedule R. Legal experts provide clarity on compliance matters, ensuring adherence to IRS regulations and mitigating risks. They are essential for resolving disputes, interpreting tax laws, and addressing uncertainties. Their guidance is critical in high-stakes scenarios, offering tailored solutions to protect the organization’s interests and maintain tax-exempt status. Legal counsel ensures that all disclosures and transactions are appropriately handled, safeguarding the organization’s compliance and reputation.

Impact of Schedule R on Tax-Exempt Status

Accurate reporting on Schedule R is crucial for maintaining tax-exempt status. Non-compliance can lead to penalties, loss of exemptions, and public scrutiny, risking the organization’s reputation and operational continuity.

14.1 Compliance and Tax-Exempt Status

Compliance with Schedule R requirements is essential for maintaining tax-exempt status. Proper disclosure of related organization transactions ensures transparency and adherence to IRS regulations, preventing potential penalties or revocation of exempt status. Accurate reporting demonstrates organizational integrity and accountability, which are critical for public trust and sustained exempt status. Failure to comply may result in IRS scrutiny and adverse actions, impacting the organization’s operations and reputation. Detailed documentation and adherence to guidelines are vital for maintaining compliance and tax-exempt status.

14.2 Public Disclosure Requirements

Schedule R filings are subject to public disclosure, ensuring transparency in transactions with related organizations. The IRS mandates that tax-exempt organizations make their Form 990, including Schedule R, available for public inspection. This promotes accountability and public trust. Non-compliance with disclosure requirements may result in penalties or loss of tax-exempt status, emphasizing the importance of accurate and timely reporting to maintain organizational integrity and adhere to regulatory standards.

Future Updates and Changes

The IRS periodically updates Schedule R to reflect legislative changes, improve clarity, and enhance reporting requirements, ensuring compliance with evolving tax laws and regulations for tax-exempt organizations.

15.1 Expected Revisions to Schedule R

The IRS plans to refine Schedule R to simplify reporting for exempt organizations, enhance clarity on related organization transactions, and align with updated tax regulations. These changes aim to reduce administrative burdens while improving transparency. Revisions may include streamlined disclosure requirements and updated terminology to reflect current compliance standards. Organizations should monitor IRS announcements for specific updates and implementation timelines to ensure proper filing.

15.2 Staying Informed About IRS Updates

Organizations should regularly check the IRS website for updates to Schedule R and Form 990. Subscribe to IRS newsletters and follow official social media channels for timely notifications. Additionally, reviewing the IRS Tax Exempt and Government Entities (TE/GE) updates ensures awareness of regulatory changes. Staying informed helps organizations maintain compliance and adapt to any revisions in reporting requirements efficiently.